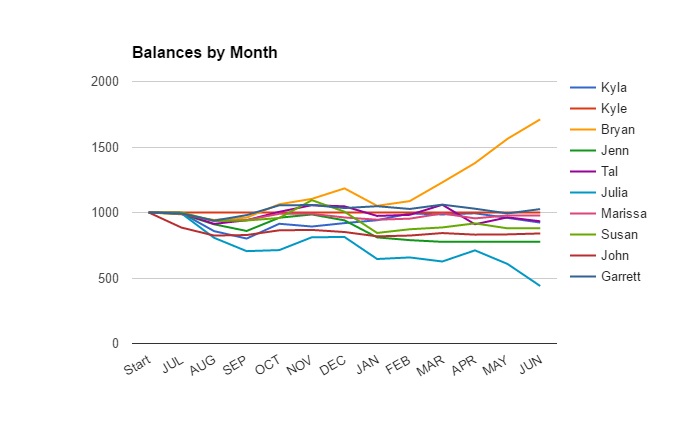

After a year of ten novice investors, ten accounts, and $10,000, we have some RESULTS. Market indexes such as the S&P 500, Dow Jones Industrial Average, and the Nasdaq Composite each outpaced the return on investment for the group as a whole. Once the twelve months had passed, the group lost 4.95% of the original $10,000, and most indexes only lost about 1%-1.5% over the same time period.

As you can see, one participant did exceptionally well. Bryan’s boost from February through June was primarily from a well-timed purchased of AMD stock. Another participant did exceptionally poorly, jumping from one losing position to another. As you can see from the graph, most did not break even.

As the organizer of the experiment, I was able to see and track all trades. Now that it’s complete, the following investing fundamentals are now proven once again:

- Cutting Losses: Never watch an investment of yours continue to drop with the hope that it will bounce back. Once you’ve lost 15%-20%, it is almost certainly time to cut your loss and sell. According to Warren Buffet and Benjamin Graham, cutting your losses is the most important investing concept.

- Acting on Impulse – The stock market – and most investors – are driven by impulses and short term market news. Taking 24 hours or more before placing a trade will help to alleviate speculative purchases. Many participants changed their minds from one stock to another in a matter of hours.

- Beating the Market – Only one of the experiment’s participants managed to beat the market, and he did so by buying a risky stock that fluctuates wildly. Especially for novice investors, index funds are your friend. They will keep pace with the market. Why? Because that’s exactly what they are designed to do!

One opportunity that the experiment uncovered was in text trading. Given the convenience of trading through me, a majority of participants opted to text their trades via SMS. I don’t think many major brokerages support this functionality at this time, so text trading may be an unmet need in the investing market.