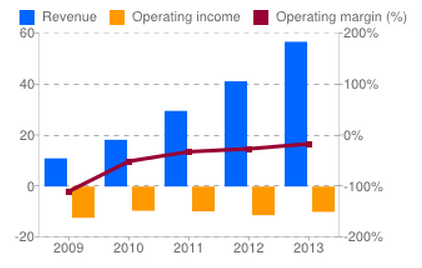

Rally Corporation (RALY) is a company based in Boulder, Colorado, and just had a very successful IPO in April. The offering price enjoyed a nice 30% bump on the day of the IPO, making any institutional investor who grabbed pre-IPO shares pretty happy. Rally develops software as a service tools for organizations that use the popular Agile Development Methodology. Agile is a methodology for teams to plan work into short “iterations” of a few weeks. This contrasts the traditional Waterfall methodology, where project requirements are defined and then developed over many months or years. Rally Corp is brand new to the public market, so the stock price doesn’t have much history for us to refer to, but we can look at the fundamentals to set the stage for our analysis. Rally is a tiny company with a Market Cap of just over 400 million, and has been burning through cash at a widening rate over the past four quarters, while increasing revenue at the same time. Founded in 2001, Rally has never been profitable, even with a strong upward trend in revenues and an upward trend in margins since 2009. Those encouraging trends may point to untapped potential and future returns. Let’s breakdown the software market, economic factors, and the company’s leadership before we make any conclusions.

Economic factors benefit Rally immensely. The Technology sector – the primary user group of Rally’s products – still enjoys unemployment around 5%, well under the national average. A healthy tech sector that shows no signs of slowing means more users, demand, and growth. Unlike the automotive industry, which is tied closely to overall economic health, Rally’s products are not cyclically tied to sweeping changes in the economy. Like other software services, adopting Rally’s core product can be a subject of great debate in a workplace, purely for the fact that software adoption is difficult to change quickly, and because software developers can be very opinionated. Just as a company can take forever to shut down a legacy system, a long time is needed to migrate away from Rally, especially in slow moving, monolithic companies that Rally is increasingly providing services to. For investors however, this ensures that Rally’s revenue stream will remain consistent and protected, thanks to the slow-to-change clients and the still booming tech sector.

Rally is the market leader in agile development software. The twelve year old company has an impressive customer list, with more than 1/3 of Fortune 100 companies as clients according to their S-1 filing. An important trend to consider that will continue to support Rally’s income is that more and more companies are adopting the agile development methods that Rally is designed to complement. The increased effectiveness of Agile shown by numerous studies has turned thousands of CEOs in all industries to lead their organizations to adopt Agile. With more organizations operating in the Agile framework, Rally’s customer base continues to expand.

Regarding profitability, Rally has tried to expand its product line horizontally, by offering another SaaS product called Rally Portfolio Manager that plugs into the existing suite, but at an additional cost. I attended the company’s RallyON conference in 2012 before the company went public, immediately after the launch of Rally Portfolio Manager. Both users and employees admitted that the product was lacking in features at the time. While the Rally Portfolio Manager is the logical next step for the company, at this time I wouldn’t expect it to quickly start adding to the bottom line. I’m extremely familiar with Rally’s core product, and must admit that nothing is stopping another company from offering a similar product for a lower price – or worse – for free. The barrier to entry in the big business market is too great for a small start-up though, and such a competitor wouldn’t be able to pop-up overnight and immediately steal all of Rally’s Fortune 100 clients. From an investor perspective, due to the high visibility of the B2B software industry, any competing company will be seen and analyzed by Wall Street analysts well in time to make any trades.

The leadership at Rally Corp is exactly what an investor would like to see at a recently IPO’ed start-up. CEO Timothy Miller has been with Rally for the past ten years, continuing his career in technology. Ryan Martens, the Founder and CTO, has prior start-up experience and extensive experience in application development. CFO Jim Lejeal has founded and managed several companies, and has the most experience of the bunch in regard to publicly traded companies. These leaders are well-positioned to guide the company to customer growth and financial success.