Acquisitions and Strategy

The age old expression “you have to spend money to make money” drove Yahoo (YHOO) and CEO Marissa Mayer to acquire Tumblr for $1.1 Billion. Yahoo already owns several social-media focused business units like Flickr, GeoCities, Koprol, Snip.it, and Bix. Buying Tumblr caught the most headlines, but Yahoo also acquired eight other companies in the second quarter: Summly, Astrid, Milewise, Loki Studios, Go Poll Go, PlayerScale, Rondee, and Ghostbird Software. The Tumblr acquisition adds a massive blogging platform to accompany the successfully rebooted Flickr photo service. Tumblr focuses on blogging in the purest form – simple paragraphs and heavy use of media, with a nod to extensive community commentary. A quarter-million new blogs are created every day, and each creates more internet real estate for Yahoo’s display advertisements. Mayer’s strategy is to focus Yahoo on four key areas: Search, Mobile, Display, and Video. The advertising market in these segments looks to be held by Google (GOOG) and Facebook (FB). If Yahoo is to continue to exceed financial expectations in CEO Marissa Mayer’s four areas of focus, success hinges on driving searches and advertisements with user-generated content.

Earnings and Revenue

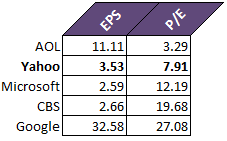

Yahoo continued to buyback shares as part of the $5 Billion buyback program announced last year. On the Q2 2013 earnings call, CFO Ken Goldman announced that $1.9 Billion in shares remain to be repurchased. With less common stock shares outstanding  in the market, buybacks will drive earnings per share (EPS) higher and the price-to-earnings ratio (P/E) lower. A positive EPS and low P/E are both fundamental indicators of a healthy, profitable company. Yahoo’s relatively low P/E of 7.91 is not uncommon for similar companies [see graphic, right].

in the market, buybacks will drive earnings per share (EPS) higher and the price-to-earnings ratio (P/E) lower. A positive EPS and low P/E are both fundamental indicators of a healthy, profitable company. Yahoo’s relatively low P/E of 7.91 is not uncommon for similar companies [see graphic, right].

To help pay for the share buyback and all of Yahoo’s acquisitions, the company sold $846 million of their preferred shares of the Alibaba Group, the Chinese E-Commerce giant. With new companies being acquired at an increasing rate and a $1.9 Billion left to buyback, Yahoo is burning through cash. Between the end of Q1 2013 and the end of Q2 2013, the company’s cash stockpile decreased by $600 million. $4.8 Billion in cash remains on their balance sheet after Q2 2013 though, so Yahoo is not at risk to dip into the red anytime soon.

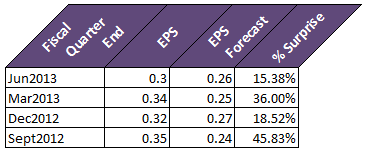

Further fundamental analysis suggests that Yahoo is still an attractive investment even after the stock has gained over 60% in the past year. The Beta of just 0.83 shows that the stock is less volatile than the rest of the market. A low beta is ideal for a long position in the stock, since the share price is less likely to have sweeping changes and fluctuations, potentially giving investors more time to contemplate a change in position. The PEG ratio average for Yahoo’s industry is 2.97%, while the entire S&P stands at 1.98%. The PEG ratio – the P/E divided by the expected growth rate – is 1.28% for Yahoo, showing that Yahoo is less expensive compared to the rest of the market. Quarterly earnings reports are a huge perception of performance and health, and Yahoo’s Q2 results continued the company’s earnings beat.

Further fundamental analysis suggests that Yahoo is still an attractive investment even after the stock has gained over 60% in the past year. The Beta of just 0.83 shows that the stock is less volatile than the rest of the market. A low beta is ideal for a long position in the stock, since the share price is less likely to have sweeping changes and fluctuations, potentially giving investors more time to contemplate a change in position. The PEG ratio average for Yahoo’s industry is 2.97%, while the entire S&P stands at 1.98%. The PEG ratio – the P/E divided by the expected growth rate – is 1.28% for Yahoo, showing that Yahoo is less expensive compared to the rest of the market. Quarterly earnings reports are a huge perception of performance and health, and Yahoo’s Q2 results continued the company’s earnings beat.

CEO Marissa Mayer’s Strategies are Working

The revolving door of candidates at Yahoo’s CEO position for the past few years left the company misguided and lacking a vision. Mayer’s leadership has energized Yahoo’s employees and given the company a firm direction. With the Tumblr blogging platform now a part of Yahoo, Mayer is looking to solidify Yahoo’s business in mobile and display, as she mentioned in the Q2 earnings call. Aside from turning Yahoo’s financials around, Mayer has changed the culture at Yahoo immensely. Since Mayer started at Yahoo in July 2012:

- The stock price has gained over 50%

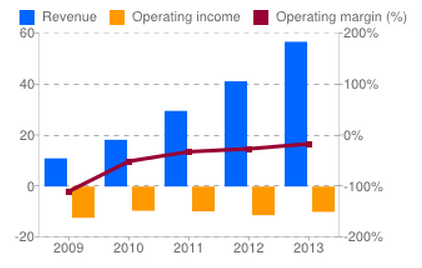

- Falling revenue ($7.5 Billion in 2008 to $5.5 Billion in 2012) has stopped falling

- Employee attrition has decreased 59% year over year

- 12% of new hires are Old Employees returning

In one of the most clever business moves in recent memory, Mayer decreed that employees would no longer be able to work remotely from offices due to widespread reports of an unproductive remote workforce. Any employee who cannot adhere to this policy “should quit.” Without the morale impact of a layoff, Mayer effectively trimmed resource costs and increased efficiency. I doubt that this move was a layoff in disguise, but the result of better teams and cutting costs is very similar.

With a clear business strategy in four key areas, a competent leader who is reshaping the culture, and rising earnings results, don’t be surprised if Yahoo’s stock continues to rise.